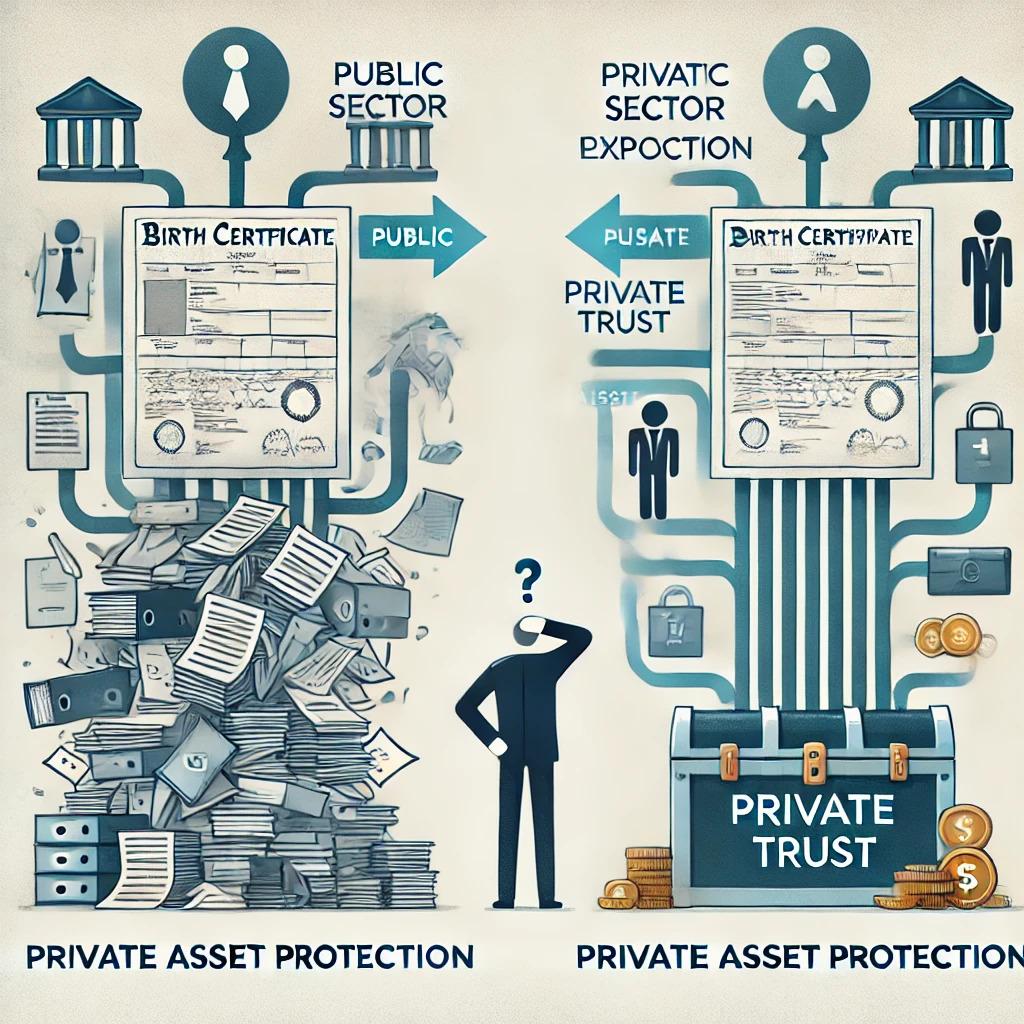

In a world where financial stability often feels elusive, many people believe their assets are safe within the public financial system. Yet, there’s a fundamental risk most haven’t considered: by holding assets in their public or “strawman” name, they are exposed to the vulnerabilities of the U.S. Inc. system. This public sector visibility can compromise true asset security and hinder the potential for building generational wealth. To protect your wealth, it’s essential to understand the hidden risks of public assets and why establishing a Private Estate Plan is the way forward for genuine financial freedom and legacy.

What Does It Mean to Hold Assets in the “Public Sector”?

When you own assets in the public sector, such as in bank accounts or property deeds under your given, or “strawman,” name, they are directly tied to the U.S. Inc. vessel—essentially making them part of the public system. This visibility subjects your assets to oversight, claims, and regulations, leaving them vulnerable to creditors, taxes, and even sudden regulatory changes. By aligning your finances with this public structure, you’re exposing them to potential forfeiture or intrusion, ultimately compromising your financial independence.

---

Understanding the “Strawman” Concept: A Working Class Trap

The “strawman” is essentially your public identity—a representation of you used in government records and public sector transactions. Most people unwittingly use this strawman name for all their financial activities, placing their assets directly under the jurisdiction and risks of U.S. Inc. While it may seem convenient, this setup traps individuals in a working-class mindset, where true asset security and control remain out of reach.

Think of it this way: the public system is a vessel controlled by U.S. Inc., subject to regulation, taxation, and other forms of control. When you place your wealth in this vessel, you’re forfeiting a degree of control, ultimately aligning yourself with working-class burdens rather than a secure, business-class approach to asset protection.

Why the Public Sector is a Calamitous Risk for Your Assets

Operating entirely within the public sector leaves you at risk of sudden financial burdens and regulatory interference. Here’s why relying solely on public structures can be detrimental:

- **Visibility to Creditors**: Public assets are easy for creditors to locate and claim in cases of unpaid debt.

- **Taxation Risks**: Holding assets in the public sector subjects them to higher taxation and potential penalties.

- **Lack of Privacy**: Public records mean that your assets are visible, increasing exposure to claims, taxes, and potential legal complications.

- **Unpredictable Regulations**: Regulatory changes in the public sphere can impact asset value, accessibility, or even ownership, often with little notice.

---

The Foreign, Secure Alternative: The Private Sector

Unlike public assets, private sector assets are foreign to U.S. Inc.—existing outside the public jurisdiction. This means they are not subject to the same regulations, taxes, or oversight as public assets. Private sector structures, such as trusts or estates, keep assets off the radar, offering a secure environment to grow and protect wealth for generations.

---

What Is a Private Estate Plan and Why Is It the “Business Class” Approach?

A Private Estate Plan is an arrangement that places assets within a private trust or estate, creating a secure barrier between your wealth and the risks of the public sector. By establishing a Private Estate Plan, you’re choosing a “Business Class” approach to managing assets, one that prioritizes protection, privacy, and legacy building over the instability of the public financial system.

- **True Ownership**: In a private trust, assets aren’t owned in your strawman name but by the trust itself, protecting them from public claims.

- **Legacy Control**: Private estates allow you to structure your wealth so it can be passed to future generations without interference.

- **Tax Efficiency**: Private estates can offer tax benefits, making it easier to preserve wealth without public tax burdens.

---

Steps to Transition to a Private Estate Plan

Securing your assets through a Private Estate Plan doesn’t have to be complex. Here’s a step-by-step guide to get started:

1. **Evaluate Your Assets**: Begin by identifying which assets would benefit most from private sector protection, such as properties, business interests, and investments.

2. **Consult a Private Financial Specialist**: Working with experts in private asset management can help you design a customized plan tailored to your goals.

3. **Choose the Right Structure**: Select a trust or estate structure that best aligns with your financial objectives, privacy needs, and legacy plans.

4. **Fund the Trust or Estate**: Transfer your assets to the private trust or estate, making them legally distinct from your public strawman identity.

5. **Update and Maintain Your Plan**: Periodically review your estate plan to ensure it remains aligned with your goals and adapts to any changes in your life.

---

The Security and Privacy Advantages of a Private Estate

With a Private Estate Plan, you’re effectively shielding your wealth from visibility, making it much harder for public entities, creditors, or litigators to access your assets. This structure prioritizes:

- **Privacy**: Assets held in a private estate are generally invisible to public records, reducing exposure.

- **Security**: By removing assets from the public domain, you’re effectively protecting them from sudden regulatory changes or claims.

- **Control Over Distribution**: Private estates allow you to determine exactly how and when your wealth is distributed, ensuring your legacy is protected according to your wishes.

---

How the Private Sector Keeps Your Assets Foreign and Safe

When you operate in the private sector, your assets are legally considered “foreign” to U.S. Inc., which removes them from the reach of public claims. By moving your assets into private trusts or estate plans, you’re effectively placing them in a secure, sovereign territory where they are shielded from public interference.

---

Common Misconceptions About Private Estate Plans

Despite their benefits, misconceptions about private estate planning can prevent people from exploring it fully:

- **“It’s Only for the Ultra-Wealthy”**: Private estate plans are beneficial for anyone with assets to protect, not just the ultra-wealthy.

- **“It’s Complicated and Expensive”**: While setting up a Private Estate Plan requires planning, the security and tax benefits can far outweigh the initial costs.

- **“It’s Not Necessary if I Have Insurance”**: While insurance covers certain risks, it doesn’t protect against all types of public exposure or asset claims.

---

Choosing a Private Estate Plan is about more than just financial security—it’s about ensuring peace of mind. With private estate protection, you’re free from the stress of potential asset seizure, intrusive regulations, and the visibility risks of the public sector. Instead, you gain control, privacy, and the confidence that your wealth is safe and ready to pass on to future generations.

---

**Conclusion**

By moving your assets from the vulnerable public sector into a secure, private structure, you’re choosing a path of financial independence, security, and peace. Embracing a Private Estate Plan isn’t just about protecting what you have; it’s about building a lasting legacy free from public interference. Take control of your financial future and start creating a secure foundation today.

Ready to secure your wealth? Book a complimentary consultation to explore your Private Estate Plan options today!---

**FAQs**

1. **Why is the public sector risky for holding assets?**

Assets in the public sector are subject to visibility, regulatory control, and claims from creditors, which makes them vulnerable to sudden losses.

2. **What does “strawman” mean in asset protection?**

“Strawman” refers to the public legal identity, often used in official transactions. Using this identity for all finances can expose assets to public risks.

3. **Can anyone set up a Private Estate Plan?**

Yes, anyone with assets can benefit from a Private Estate Plan, which is designed to protect and manage wealth securely.

4. **How does a private trust differ from a will?**

A private trust offers ongoing control and privacy over assets, while a will only directs assets after death and is publicly recorded.

5. **Does private asset protection replace the need for insurance?**

Private asset protection adds a layer of security beyond insurance, covering risks that insurance alone cannot mitigate.